november child tax credit date

You will not receive a monthly payment if your total benefit amount for the year is less than 240. The fifth payment date is Monday November 15 with the IRS sending most of the checks via direct deposit.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

IR-2021-222 November 12 2021.

. A more generous Child Tax Credit boosted refunds for some taxpayers. 1 was the deadline to change income banking or address information for that payment. However the deadline to apply for the child.

November Child Tax Credit Date. Benefit and credit payment dates reminders. A more generous Child Tax Credit boosted refunds for some taxpayers.

However families can still opt out for the final two checks by un-enrolling via the Child Tax Credit Update Portal by these dates. The final payment for the year will arrive Dec. The payments go out on the 15th of each month except on weekends so the November payment will come Monday.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit. Enter your information on Schedule 8812 Form.

When does the Child Tax Credit arrive in November. Some families should expect a. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

Your next child tax credit payments could be worth 900 per kid Credit. The Build Back Better Framework extends the expanded Child Tax Credit and ensures more than 35 million American families get the help they need. To reconcile advance payments on your 2021 return.

The remaining payments will arrive October 15 November 15 and December 15 each total up to 300 per child under age six and up to 250 per child ages six through 17. The 2021 advance monthly child tax credit payments started automatically in July. Low-income families who are not getting payments and have not filed a tax return can still get one but they.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Getty For qualified families who opted for paper checks those will begin to hit mailboxes through the end of September. November 1 for the November 15 payment.

For most people the combined total of the six monthly payments will equal 50 of the child tax credit theyre expected to qualify for on their. Dates for earlier payments are. 15 opt out by Nov.

The deadline for the next payment was November 1. 15 opt out by Aug. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the.

ET on November 15 to receive the monthly payment as a lump sum in December. 13 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Deborah Ann Last Updated. Go to My Account to see your next payment. 15 opt out by Oct.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. The Internal Revenue Service will soon start sending out the advanced payments of the child tax credit for November.

The fifth advance child tax credit CTC payment is being disbursed by the IRS starting Monday sending an estimated 15 billion to around 36 million families the agency said last week. 15 is also the date the next monthly child tax credit payment will be sent out. Wait 5 working days from the payment date to contact us.

15 opt out by Nov. They can use another portal to register to receive the enhanced child tax credit but must do so by 1159 pm. Related services and information.

Enter your information on Schedule 8812 Form 1040. Kamala Harris KamalaHarris November 4 2021. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it.

Alberta child and family benefit ACFB All payment dates. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The taxpayers that have eligible children under the age of 6 receive 300 per child and 250 for every child between 6 and 18.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. Get your advance payments total and number of qualifying children in your online account. November 25 2022 Havent received your payment.

Instead you will receive one lump sum payment with your July payment. The stimulus check part of President Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. Wait 10 working days from the payment date to contact us.

Instead of calling it may be faster to check the. 29 What happens with the child tax credit payments after December.

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Updates On 38th Gst Council Meeting Gstr 9 Meeting Council Financial Information

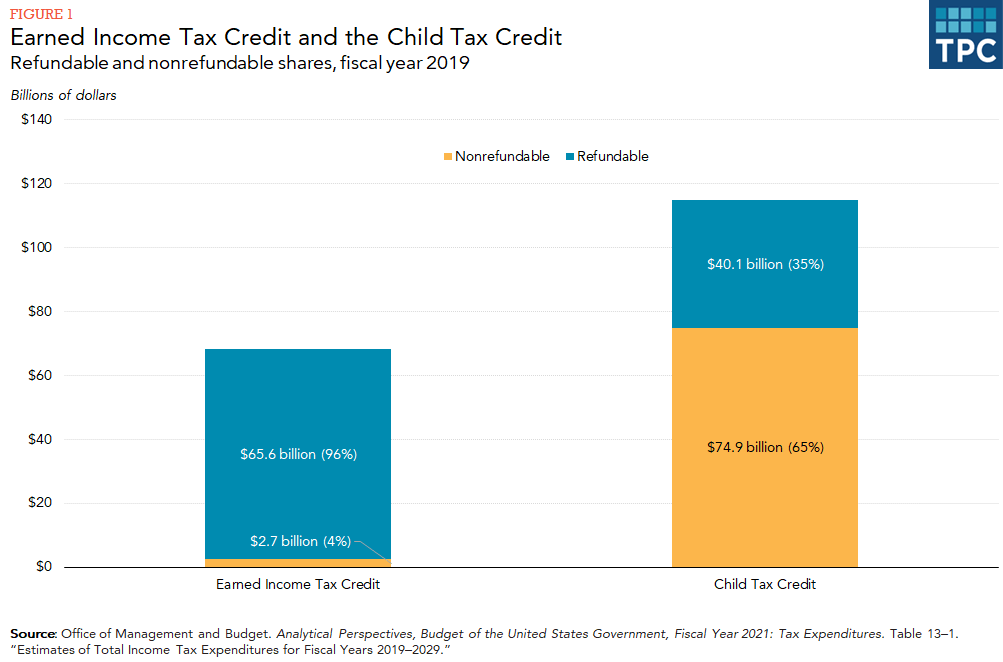

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Refundable Tax Credits Congressional Budget Office

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2022 Schedule Irs Refunds On The Way For Millions After April Deadline How To Track Yours

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Child Tax Credit 2021 8 Things You Need To Know District Capital

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

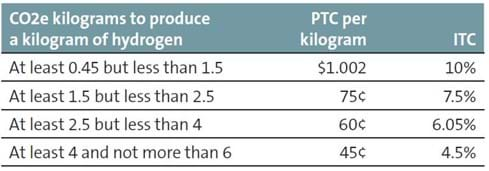

Hydrogen Funding And Tax Credits Norton Rose Fulbright December 2021

Thousands Of Low Income Families To Get 1 800 Per Child Tax Credits Next Month

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back